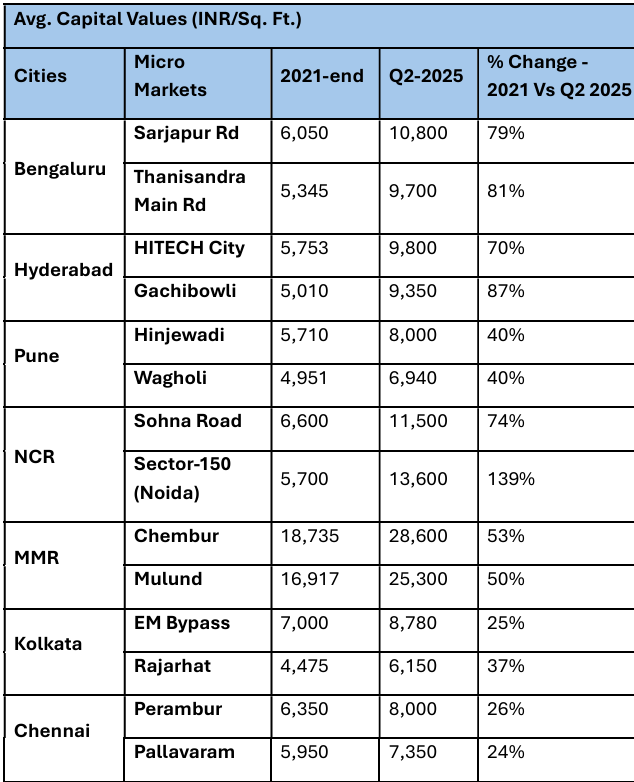

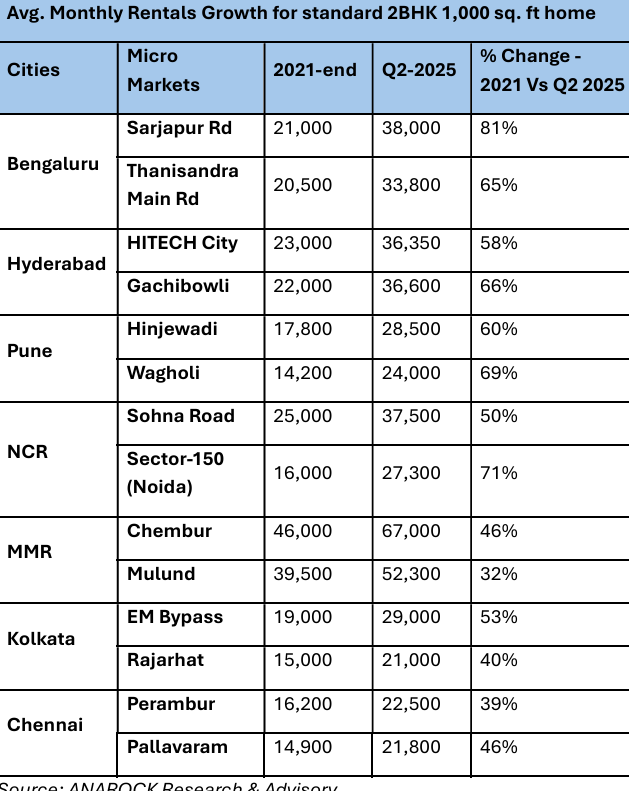

India’s housing market has delivered spectacular gains since 2021, with some micro markets recording price jumps of over 100% and rent hikes far outpacing inflation, according to latest ANAROCK Research.

Across 14 key micro markets in seven major cities, capital values rose between 24% and 139%, while rentals grew 32%–81% between end-2021 and Q2 2025.

Top gainer: Sector-150, Noida emerged as the national leader, with property prices soaring 139% to ₹13,600 per sq. ft and rents up 71% to ₹27,300/month, powered by large-scale township projects and investor demand.

Bengaluru’s boom: Sarjapur Road (up 79% in prices, 81% in rents) and Thanisandra Main Road (up 81% in prices, 65% in rents) benefited from IT corridor expansion and upcoming metro lines.

Hyderabad’s tech hubs: Gachibowli saw an 87% price rise and 66% rent growth, while HITEC City gained 70% in prices and 58% in rents, thanks to strong IT demand and limited ready-to-move inventory.

Pune’s steady climb: Wagholi and Hinjewadi clocked 40% price growth, with rentals rising up to 69%, fuelled by affordability and corporate leasing.

Mumbai MMR: Chembur (prices up 53%, rents 46%) and Mulund (50%, 32%) gained from metro and freeway connectivity.

Other key risers: Kolkata’s Rajarhat (37% prices, 40% rents), Chennai’s Pallavaram (24%, 46%) and Perambur (26%, 39%) underline how transit access drives returns.

Source: ANAROCK Research & Advisory

Drivers of growth: Infrastructure upgrades, proximity to job hubs, master-planned developments, and affordability were the common success factors.

“The recovery that began in 2021 was driven by pent-up demand, record-low interest rates, and a structural shift toward homeownership after the pandemic. In the early recovery years, annual rental increases of 12–24% were common in prime employment hubs. By H1 2025, rental growth had moderated nationally to 7–9% — still ahead of consumer inflation, but a lot more sustainable,” said Anuj Puri, Chairman – ANAROCK Group.

ANAROCK has studied capital appreciation and rental value growth trends across 14 of the most active (in terms of supply and sales) micro markets in Bengaluru, Hyderabad, Pune, NCR, Mumbai Metropolitan Region (MMR), Kolkata, and Chennai – and unpa

“Capital values followed a similar trajectory of rapid appreciation between 2021-2023, followed by steadier gains as new supply hit the market and buyers became more price sensitive,” said Puri. “Notably, infrastructure-led markets (those benefiting from new metro lines, expressways, or new planned tech hubs) continued to defy this cooling trend.”

Bengaluru: Sarjapur Road & Thanisandra

Bengaluru’s tech corridors are still a magnet for capital and rental growth. Sarjapur Road, part of the city’s eastern IT belt, has surged 79% in capital values and 81% in average 2BHK rents (₹38,000/month), aided by the upcoming Red Line Namma Metro and the proposed ‘Swift City’ mega-tech hub.

In the north, Thanisandra Main Road has clocked an even higher 81% capital gain, with rents up 65%, driven by proximity to Manyata Tech Park and improved road links.

Hyderabad: HITECH City & Gachibowli

In the western corridor, HITECH City has seen 70% price growth and 58% rent appreciation. Gachibowli has fared even better—87% price growth and 66% rental rise—thanks to a concentration of MNC offices, international schools, and high-end housing.

Pune: Hinjewadi & Wagholi

Hinjewadi, home to Pune’s largest IT park, posted 40% price growth and 60% rent gains. Wagholi matched the capital growth but led rentals with a 69% surge, attracting first-time investors with its lower entry costs.

NCR: Sohna Road & Noida Sector-150

Sohna Road has climbed 74% in prices and 50% in rents, benefiting from corporate leasing demand and expressway connectivity.

Noida’s Sector-150 tops the national charts with an extraordinary 139% jump in prices and 71% rental growth, fuelled by new township projects, greenfield layouts, and premium sports-themed developments.

Mumbai Metropolitan Region: Chembur & Mulund

Chembur’s transformation via the Eastern Freeway and Metro expansion has driven 53% price growth and 46% rent hikes.

Mulund, a strategic link between Mumbai and Thane, saw 50% price growth, with more modest rent increases (32%).

Kolkata: EM Bypass & Rajarhat

EM Bypass grew 25% in prices and 53% in rents, while planned township Rajarhat recorded 37% and 40% respectively—steady gains supported by infrastructure and corporate presence.

Source of this article: Business Standard