In a move that could impart a new dimension to urban development in the National Capital Region (NCR), the Central Board of Direct Taxes (CBDT) has granted the New Okhla Industrial Development Authority (NOIDA) a crucial income tax exemption under Section 10(46A) of the Income Tax Act. Effective from Assessment Year 2024–25, this exemption allows Noida to retain more of its non-commercial revenue—rent, government grants, and public service fees—free from income tax.

But what does this mean for investors, businesses, and residents? Experts suggest that if NOIDA strategically channels these savings into infrastructure upgrades, the region could see a surge in property values and rental yields, making it an even hotter investment destination.

The Fine Print: What’s Tax-Free and What’s Not

The exemption isn’t a blanket waiver. Noida’s commercial income—such as revenue from real estate sales, interest on investments, or profit-driven ventures—remains taxable. The authority must also maintain strictly segregated accounts for exempt and taxable income, as per CBDT Notification No. 116/2025. Any misuse could lead to a complete withdrawal of the benefit.

This is a far-sighted step. It will enable Noida Authority to improve infrastructure such as better roads, metro connectivity, or drainage systems. Not only will it add to the investor potential of the city, but it will also enhance the region’s appeal. This, in turn, will lead to price appreciation and higher return on investments.

Noida’s ability to retain more revenue means it can reinvest in critical infrastructure without the leakage of income tax. Historically, infrastructure upgrades have a direct correlation with property appreciation.

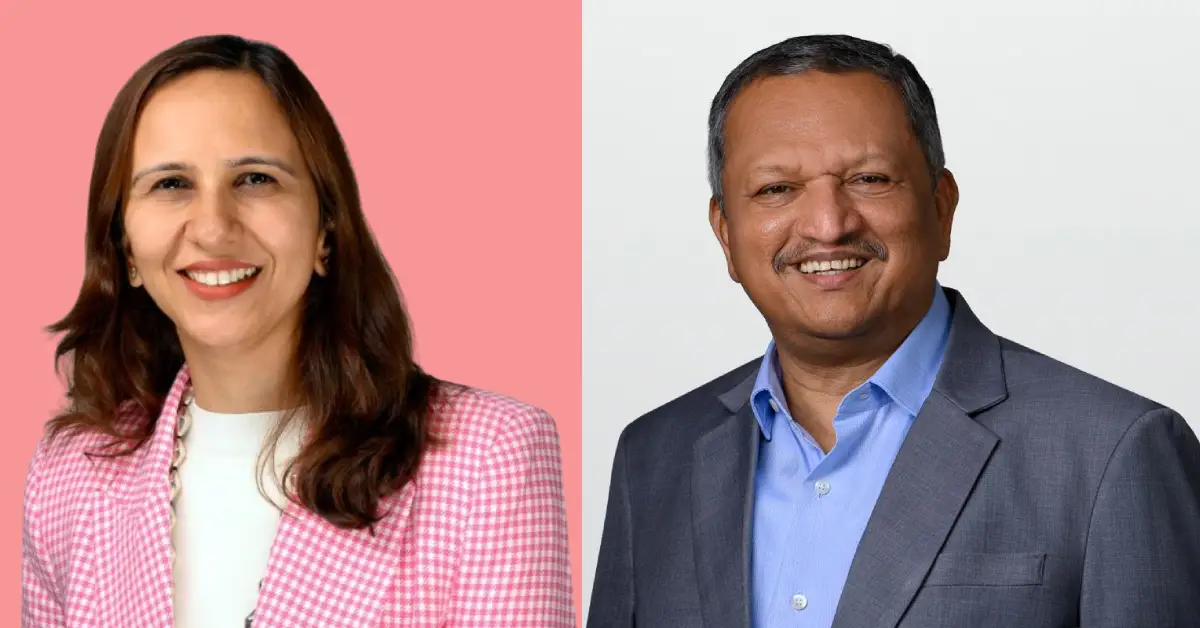

Sahil Agarwal, CEO of Nimbus Realty said , ”When an area gets better roads, utilities, and public transport, demand rises. We’ve seen this in sectors like Sector 168 (near the upcoming Noida Airport) and along the Noida-Greater Noida Expressway. If Noida uses this tax break to fast-track pending projects, we could see 10-15% appreciation in prime sectors over the next three years.”

Prateek Tiwari, Managing Director, Prateek Group says “With improved infrastructure, rental demand typically follows. While private businesses won’t get a direct tax benefit, a well-funded Noida could also result in faster project approvals, which is critical for real estate developers, upgraded utilities, reducing operational headaches for industries, and long-term policy stability, attracting institutional investors”

“If Noida can now expedite approvals and improve the basic amenities, it will reduce project delays, which directly impacts ROI for developers and end-users. Every rupee saved from tax can now go into roads, housing, and utilities. This isn’t just about Noida, it’s about setting a replicable model for other urban bodies,” says Sunny Katyal, Co-Founder of Investors Clinic

Noida has a rare opportunity to turn tax savings into tangible infrastructure gains, boosting real estate returns. If executed well, this could make Noida a benchmark for urban development in India. Moreover, this exemption aligns with the government’s push for tax-efficient urban governance. Similar benefits have been extended to Sovereign Wealth Funds and Pension Funds investing in infrastructure.